tax break refund tracker

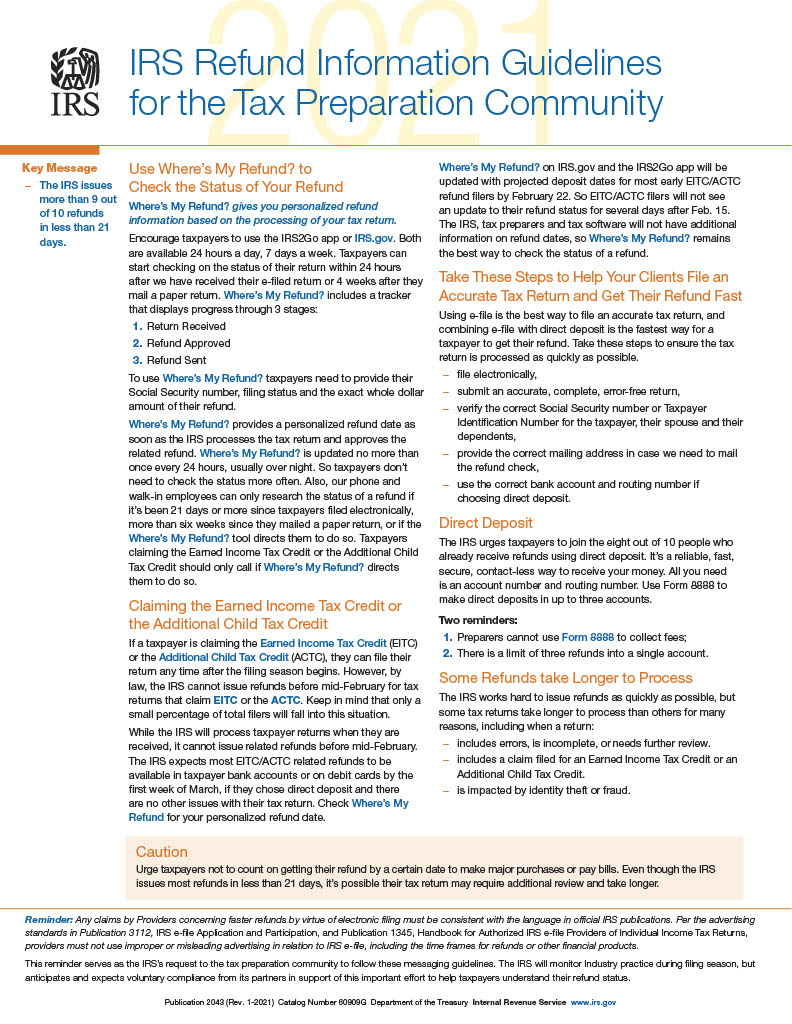

There is no tool to track it but you can check your tax transcript with your online account through the IRS. Up to 10 cash back Once the IRS accepts your return it can take up to 21 days for your refund to arrive.

Keep Flawless Records Of Charitable Donations With The Itemized Charitable Expense Workshe Small Business Tax Deductions Business Tax Deductions Tax Printables

Heres how to check your tax transcript online.

. Taxpayers can start checking on the status of their return within 24 hours after the IRS received their e-filed return or four weeks after they mail a paper return. You can still check the status of your federal income tax refund. If you havent opened an account with the IRS this will take some time as.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. At Premiere Tax Service we pride ourselves in consistently receiving excellent marks in customer satisfaction. Check For the Latest Updates and Resources Throughout The Tax Season.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. 24 hours after e-filing 4 weeks after you mailed your return Updates are made daily usually overnight Refunds Topics. The IRS can seize the refund to cover a past-due debt such as unpaid federal or state taxes and child support.

Will display the status of your refund usually on the most recent tax year refund we have on file for you. Taxpayers can view status of refund 10 days after their refund has been sent by the Assessing Officer to the Refund Banker. The Wheres My Refund tool will show the status of your tax refund within 24 hours after the IRS receives your e-filed 2021 return four weeks after a paper return for 2021 is mailed or three or.

Surprise 8000 Cash Boosts To Be Sent Out As 1000 Payments On Way This Week. Another way is to check your tax transcript if you have an online account with the IRS. The IRS receives the tax return then approves the refund and sends the refund.

The IRS says it updates payment statuses once. Your Social Security number or. Exact refund amount shown on.

For Palmdale school-age children those are the two sweetest words in the English language. The IRS will determine whether the check was cashed. Social Security number Filing status Exact refund amount shown on your return Use IRS tool Dont forget.

Wheres My Refund. Social Security Number or ITIN. Visit IRSgov and log in to your account.

Californias budget addresses the states most pressing needs and prioritizes getting dollars back into the pockets of millions of. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. Your Name required.

You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. The Wheres My Refund tool also indicates three different status levels for your refund. Up to 10 cash back Use the IRS Wheres My Refund tool to find out when you can expect your refund to arrive.

All times are estimated by IRS I mailed my paper return STEP 1 If you e-filed with TurboTax Sign in to check your federal return status and make a note of your exact refund amount. Tools and Resources Refund Tracker. To check the status of your 2020 income tax refund using the IRS tracker tools youll need to give some information.

Heres how to check your tax transcript online. Heres how to check your tax transcript online. Ad Learn How to Track Your Federal Tax Refund and Find The Status of Your Paper Check.

Go to the IRS Wheres My Refund tool and enter this info. You will be directed to the IRS Web site and need the following information. It will create a claims package that includes a copy of the endorsed cashed check if it was indeed cashed.

Add an extra two to five days from the date listed by the IRS for your bank to process the refund. Click on the button to go right to the IRSs refund tracker for federal tax refunds. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt.

This is available under View Tax Records then click the Get Transcript button and choose the. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected. You can ask the IRS to trace it by calling 800-829-1954 or by filling out and sending in Form 3911 the Taxpayer Statement Regarding Refund.

Lets track your tax refund. To see your update youll need to click the Check My Refund Status button and then follow the prompts inputting your Social Security number tax filing status and exact refund amount. Received Approved Sent Assuming you file electronically you can begin to check your status 24 hours after you file but the information wont be.

Visit IRSgov and log in to your account. Online Account allows you to securely access more information about your individual account. Ad See How Long It Could Take Your 2021 Tax Refund.

Choose the federal tax option and the 2020 Account Transcript. Learn How Long It Could Take Your 2021 Tax Refund. Sign in STEP 2 Track your federal tax refund.

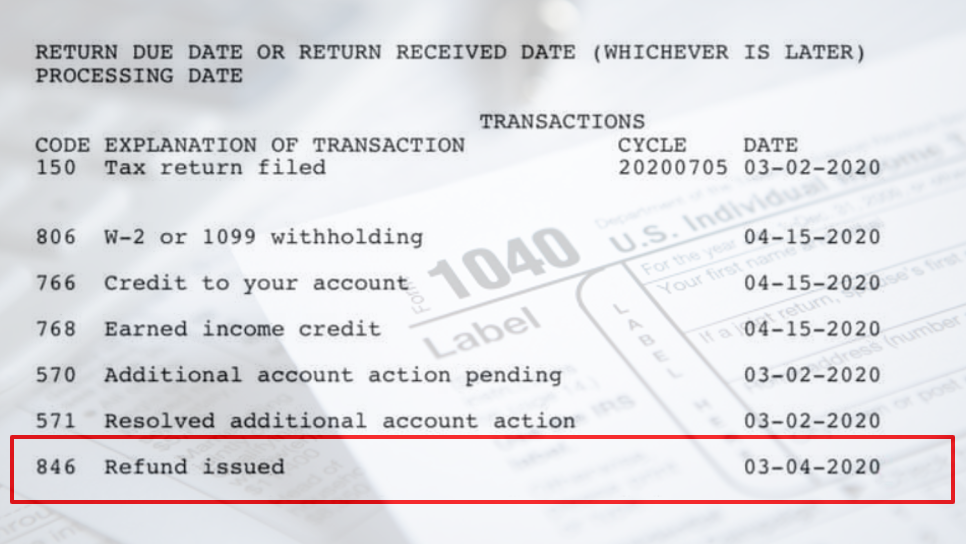

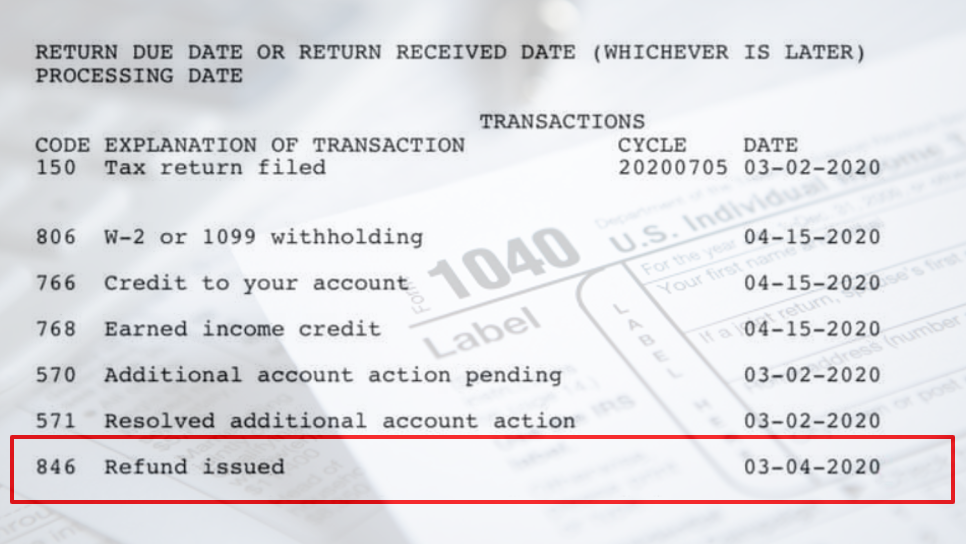

If you entered the information correctly you should see your refund status instantly. Track your IRS tax refund status. If you see a Refund issued then youll likely see a refund soon.

You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund. Using the IRS Wheres My Refund tool Viewing your IRS account information Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt.

1 day agoThe governors tax relief package also includes a 10 day tax reduction on back-to-school supplies set for August as well as some property tax relief checks being sent out automatically to. You file your return 24-48 hours The IRS accepts your return Up to 2 days The IRS approves your refund amount Up to 19 days Your federal tax refund is delivered All steps are estimated by the IRS Find out when your federal tax refund will arrive. An immediate way to see if the IRS processed your refund is by viewing your tax records online.

Includes a tracker that displays progress through three stages. The 95 billion in tax refunds which CalMatters reported Friday is part of a 12 billion relief plan that is central to a broader 300 billion budget deal that state leaders announced Sunday night.

8 Questions About The Principal Residence Tax Rules Income Tax Tax Deadline Budgeting Money

Hair Stylist Income And Expense Worksheets With Mileage Logs Atkins E Corp Hair Stylist Income Tax Deductions Income Tax Preparation

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

2019 Income Tax Filing Tips And Free Tax Organizer Atkins E Corp Tax Organization Filing Taxes Donation Tax Deduction

Gutighala Smart Watch Dz09 Smartwatch Sportowy Telefon Zegarek Na Reke Dla Iphone Android Men Women Zegarek Obsluguje K Smart Watch Smart Watches Men Bluetooth

Keep Precise Records Of Your Rental Income Business With Our Printable Rental Worksheet Bundle The Printab Rental Income Income Tax Preparation Tax Printables

Meaning Of Irs Tax Transaction Codes On Wmr Irs2go And Account Transcript For Your Tax Return And Refund Status 150 151 152 203 420 421 570 846 898 971 1121 1161 Aving To Invest

11 Simple Ways To Lower Income Tax Better Prepare Earlier Than Later Money Habits Money Saving Tips Money Saving Mom

Where S My Tax Refund The Irs Has A Tracker For That Cbs News

Rental Income Tax Everything You Need To Know Fortunebuilders Rental Income Income Tax Income Tax Preparation

How Tax Credits Work And Tax Credits To Consider Atkins E Corp Tax Credits Business Tax Deductions Business Tax

Send Itr V In Tax Department Income Tax Return Income Tax Income Tax Preparation

Where S My Refund 2022 Tax Updates Resources For Taxpayers

Tax Refund Delays Irs Treas 310 And How To Track Your Money Explained

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post